Buyers, Here’s Your Guide to Make Your Homeownership Dream Alive in 2025 [PART 1] — Urban Resource

We are committed to respecting your right to privacy and protecting your information when you use our services. This privacy policy also... Read More

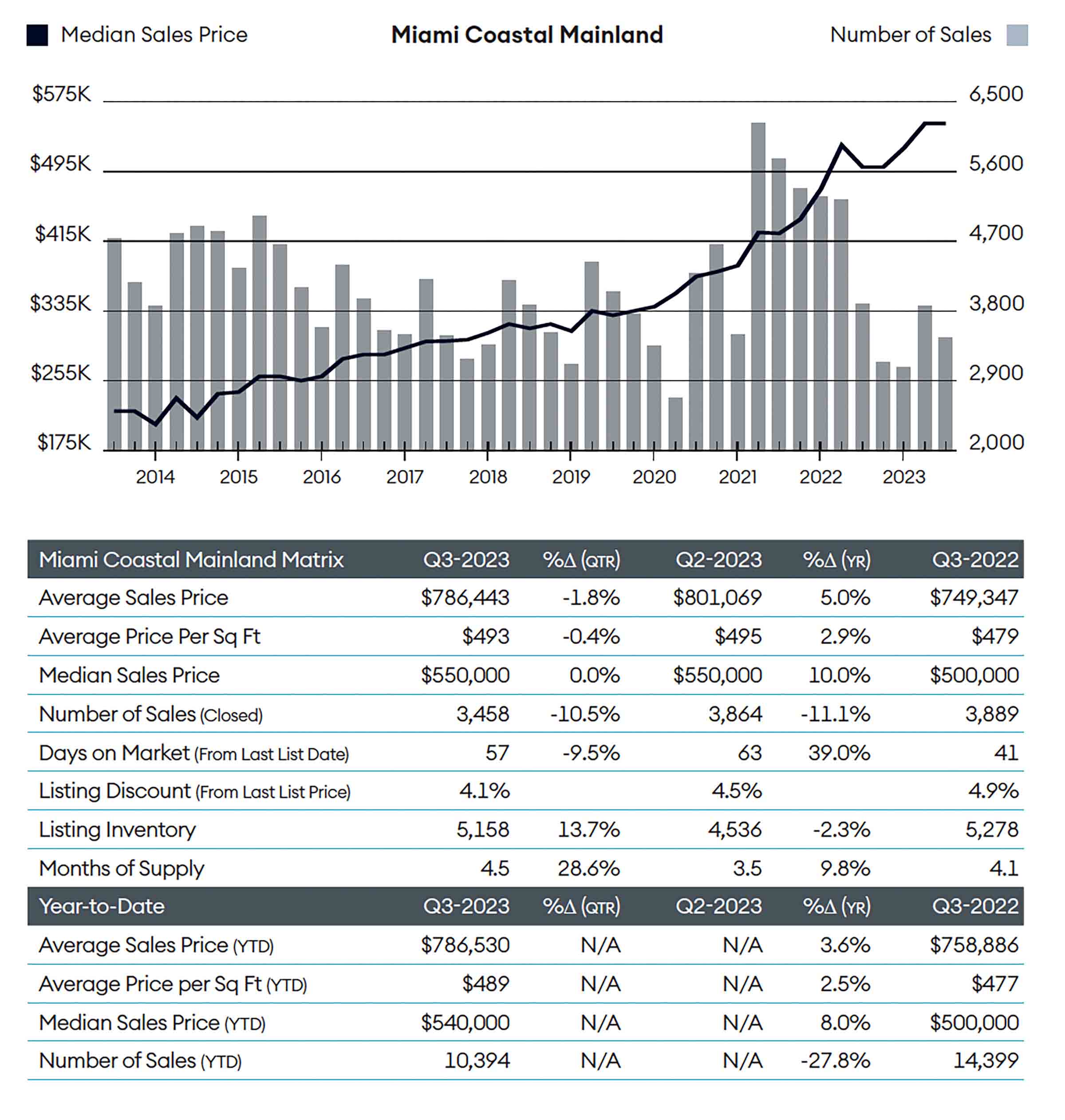

While the market in the third quarter of 2023 has slowed a bit, prices continue to rise, according to the Douglas Elliman Market Reports that are compiled quarterly by consulting group Miller Samuel.

Some of this change is to be expected, as the end of the summer (the third quarter) is historically the slowest time of year for Miami real estate. The kids are starting back to school, we are still in the midst of the balmy ending of hurricane season and high season doesn’t start until the temperatures begin to drop in early October.

Other aspects of the change are specific to the post-pandemic market conditions. We are still seeing low inventory due to the droves of northerners flocking to the sunshine state in effort to hide from cold temperatures and high taxes. Additionally, mortgage rates are still quite high, which slows things down a bit.

The Fed’s pause on rate increases has helped to garner additional traffic in the marketplace from those who are looking to leverage their purchases, but we do not expect to see any decreases to the interest rates for at least a few more quarters. Despite these rates, the demand and lack of inventory continues to push prices northward.

In the single family home market, inventory decreased 17% to 1,839 listings by the end of the third quarter, with sales also falling 5% to 1,600 closings. The average sale price held relatively steady at $786,443, which is up slightly from $749,347 from the third quarter of 2022.

With just 4.5 months’ of supply, we are still firmly in a seller’s market even though inventory is up just a titch.

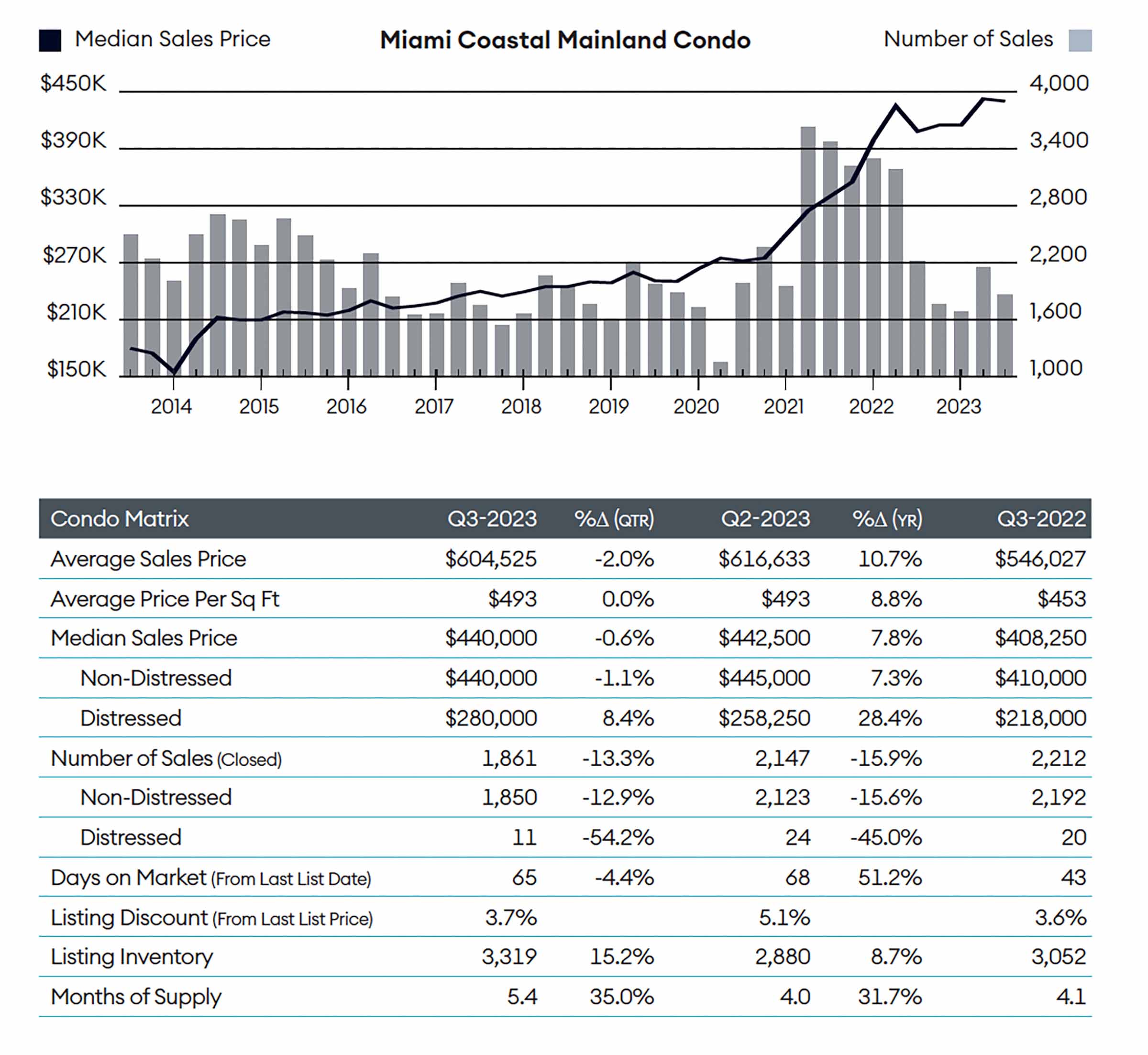

Condominium resales also took a dip. The sales volume fell 16% to 1,861 transactions at a median price of $440,000. The median price from this time last year was $408,250 which represents an 8% difference. With an increased marketing time of 65 days on market, we are currently sitting with 5.4 months of supply. This is closer to a balanced market and undoubtedly if you factor in the developer inventory, we would be in a balanced market.

These figures are representative of the macro area along the Coastal Mainland Miami, which includes everything from the Upper Eastside all the way down to Pinecrest including Edgewater, the Design District, Midtown Miami, Downtown Miami, Brickell, the Miami River area, Coconut Grove, Coral Gables, Key Biscayne and Pinecrest/South Miami.

If you would like to see the individual matrixes for your area, you may find it in the full market report below.

Download the Q3 2023 Douglas Elliman Market Report in its entirety here.

Something important to make note of with the market reports is that they measure only those deals that are entered into the MLS (Multiple Listing Service). This excludes off-market transactions and most developer sales as developers rarely keep up-to-date listings of their inventory in the MLS.

If you need or want to move in the Miami area, or if you are searching for a real estate investment, please contact Michael Light, Broker and Executive Director of Luxury Sales at Douglas Elliman, to discuss pre-qualification requirements. You may reach Michael directly at (786) 566-1700 or via email at michael@miamiluxuryhomes.com.

Join The Discussion